Blue Moon Announces Maiden NI 43-101 Sulitjelma Resource of 17 Mt @ 1.06% Cu & 0.21% Zn in the Inferred Category Supporting VMS District Growth Potential

/EIN News/ -- TORONTO, April 10, 2025 (GLOBE NEWSWIRE) -- Blue Moon Metals Inc. (“Blue Moon” or the “Company”) (TSXV: MOON) is pleased to announce a maiden mineral resource estimate (“MRE”) for the Sulitjelma volcanogenic massive sulphide (“VMS”) deposit (the “Sulitjelma Project”), located in Nordland, Norway, which has been summarized in an independent Technical Report (the “Technical Report”) prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which will be filled on SEDAR+ within 45 days after the current announcement. The Sulitjelma Project is situated within a significant mining district known for its copper deposits, with historical production between 1891 and 1991 of 26 Mt of 1.80% Cu with additional zinc, sulfur, gold and silver credits (Nordrum, F.S., 1999. Minerals from the Sulitjelma Copper Mines, North Norway).

The MRE includes 17 million tonnes grading 1.06% Cu and 0.21% Zn in the inferred category over three deposits, supporting the project's potential for further growth. The resource estimate does not include gold, silver or sulfur which were historically recovered and considered by-product credits. The Company plans to advance the project through additional exploration and technical studies to further evaluate its economic viability.

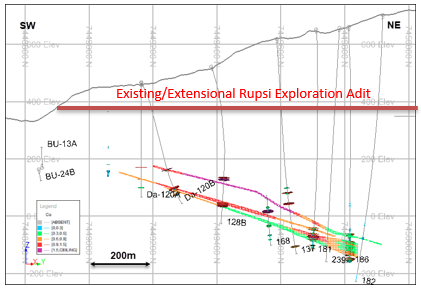

Blue Moon will initially focus on the Rupsi and Dypet deposits where the company has received Norwegian Government approval in Q1 2025 to extend an existing historical mine tunnel into the deposit by up to 1 km. The tunnel extension and the completion of 10,000 m of underground drilling are part of the recommendations in the technical report with a budget of 37 MNOK (~US$3.4M). Exploration activities will focus on the exploration target to showcase its mineral potential. Current underground workings are in good condition, ending approximately 200 m from the resource estimate outline. Blue Moon plans to extend the underground drift towards intercepts such as 19.30 m apparent true thickness grading 1.05% Cu, 0.64% Zn & 8.0 g/t Ag (DH-RD-OLD-010) later this year. Figure 1 outlines the existing 400 m long tunnel that will be extended, and the location of the mineralization at the Rupsi and Dypet deposits.

Figure 1: Interpreted model of the current estimation from Rupsi deposit including the projected exploration adit

The CEO of Blue Moon, Christian Kargl-Simard stated:

"With 100 years of production history, this resource estimate is the first NI 43-101 resource on this VMS district, in which Blue Moon holds the most important concessions. Blue Moon has the exclusive option to buy the historical processing plant infrastructure for a nominal value of 1 NOK (~US$0.1) and has access to numerous historical mining tunnels for efficient underground exploration. While the Rupsi deposit will be the focus of exploration to start, with historical intercepts such as 3.2 m apparent true thickness grading 6.82% Cu and 0.85% Zn, we think there are many other interesting targets in the district that could potentially result in several mining centres in due course. We think Blue Moon can bring back mining in this district, with a much more efficient and modern practice by the end of this decade, with exciting regular drill results. The addition of gold, silver, sulfur and cobalt in a future resource would also increase the strategic nature of the deposit. We plan to start underground development in Q3-2025.”

Mineral Resource Estimate

Table 1: Sulitjelma Constrained Resource Evaluation Statement

| Inferred Resources By Zone | Sub-Totals | |||||||||

| Region | Zone | Tonnes (kt) |

Cu (%) |

Zn (%) |

Cu_Eq (%) |

APT* (m) |

Tonnes (kt) |

Cu (%) |

Zn (%) |

Cu_Eq (%) |

| Rupsi / Dypet | 2 | 4,188 | 1.45 | 0.35 | 1.50 | 5.2 | ||||

| 3 | 1,499 | 0.95 | 0.19 | 0.98 | 5.5 | |||||

| 5 | 2,188 | 0.82 | 0.37 | 0.88 | 15.7 | |||||

| 6 | 410 | 1.40 | 0.24 | 1.43 | 3.6 | |||||

| 7 | 126 | 0.77 | 0.15 | 0.79 | 2.4 | |||||

| 8 | 484 | 0.89 | 0.11 | 0.91 | 6.8 | |||||

| 9 | 163 | 2.01 | 0.25 | 2.05 | 2.5 | |||||

| 10 | 201 | 1.39 | 0.36 | 1.45 | 2.9 | 9,258 | 1.19 | 0.31 | 1.24 | |

| Hankabakken II | 2 | 3,031 | 0.88 | 0.07 | 0.89 | 4.2 | ||||

| 3 | 1,471 | 0.86 | 0.05 | 0.86 | 3.1 | |||||

| 5 | 453 | 1.00 | 0.02 | 1.00 | 9.1 | 4,955 | 0.88 | 0.06 | 0.89 | |

| Sagmo | 2 | 455 | 1.15 | 0.19 | 1.18 | 3.6 | ||||

| 3 | 193 | 1.56 | 0.14 | 1.58 | 6.4 | |||||

| 5 | 2,205 | 0.89 | 0.15 | 0.91 | 4.1 | 2,853 | 0.98 | 0.16 | 1.00 | |

| Total | 17,066 | 1.06 | 0.21 | 1.10 | 6.1 | |||||

* Apparent True Thickness

Notes:

1. CIM definitions were followed for MRE.

2. All resources reported are categorized Inferred; there are no Measured or Indicated resources.

3. A minimum mining thickness of 2.2 m was applied in making the MRE constraint wireframes.

4. The MRE constraint wireframes were generated using a preliminary MSO, based on a cut-off grade of 0.60% CuEq, related to potential underground mining.

5. Assumed parameters for the cut-off grade and CuEq calculations included: Prices: US$4.20/lb Cu, US$1.25/lb Zn

Processing recoveries: 92% Cu, 57% Zn

Payabilities: 96.5% Cu, 86% Zn

6. The copper equivalent (CuEq) calculation is as follows: CuEq = Cu grade + (Zn grade x 0.16)

7. For the cut-off grade calculation, the assumed total operating cost was $50/t of ore.

8. A global density value of 3 t/m3was assumed.

9. Rounding may result in apparent summation differences between tonnes, grades and metal content; not considered material.

10. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

The MRE for the Sulitjelma Project is classified entirely as Inferred Mineral Resources in accordance with NI 43-101. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty additional drilling will result in the conversion of Inferred category material to either Indicated or Measured categories, or that the project will be economically viable.

This MRE work was carried out and prepared in compliance with NI 43-101, and the mineral resources in this estimate were calculated using the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council in May 2014. The Technical Report will be filed on SEDAR+ within 45 days. Conforming with guidelines for “reasonable prospects for eventual economic extraction,” constrained evaluations were completed using a Mineable Shape Optimiser (MSO) to generate wireframes. This MRE of the Sulitjelma deposit is summarised in Table 1.

For the Sulitjelma deposit, complete sets of data from 601 historic diamond drillholes have been collated, covering 78,144 m. Of these, 286 diamond drillholes have intersected mineralization within the three deposits which have had their resources estimated in the current study. 51 of these holes were drilled from surface, with the other 235 holes being drilled from underground.

The geologic continuity of Sulitjelma Project VMS mineralization is well established through core drilling and a full set of drill sections that guided 3D modelling of geology and structure to develop wireframe models. The Mineral Resource estimate considers a combination of lithological and grade domains. The following select, historic drilling results are significant intersections (reported in apparent true thickness) from either surface or underground drilling results from the deposits that comprise the Sulitjelma project:

Rupsi deposit (surface drilling)

DH-RD-OLD-010 with 19.30 m @ 1.05% Cu, 0.64% Zn & 8.0g/t Ag from 721.00m

including 7.00 m @ 2.27% Cu, 1.52% Zn & 17.2g/t Ag from 721.00m

DH-RD-OLD-012 with 47.10 m @ 0.54% Cu, 0.13% Zn from 752.00m

including 12.00 m @ 0.82% Cu & 0.06% Zn from 790.00m

DH-RD-OLD-001 with 3.42 m @ 4.03% Cu & 0.22% Zn from 393.35m

DH-RD-OLD-001 with 9.40 m @ 1.39% Cu & 0.15% Zn from 485.20m

DH-RD-OLD-004 with 11.40 m @ 1.23% Cu & 0.23% Zn from 547.50m

DH-RD-OLD-008 with 3.20 m @ 6.82% Cu & 0.85% Zn from 625.00m

Hankabakken deposit (underground drilling)

DH-HK-OLD-123 with 8.60 m @ 1.30% Cu, 0.02% Zn

DH-HK-OLD-300 with 11.70 m @ 1.21% Cu, 0.07% Zn

DH-HK-OLD-306 with 10.10 m @ 1.13% Cu, 0.06% Zn

Sagmo deposit (underground drilling)

DH-SG-OLD-30 with 6.20 m @ 1.42% Cu & 0.11% Zn

DH-SG-OLD-34 with 9.40 m @ 1.69% Cu & 0.00% Zn

DH-SG-OLD-36 with 15.80 m @ 1.60% Cu & 0.24% Zn

The compiled historic drilling data was then used to develop a sectional interpretation of mineralized vein intersections, based on a cut-off of 0.6% CuEq. The interpreted zones within each deposit in general have been extrapolated a maximum distance of approximately 100 m beyond the furthest intersection, both laterally and down-dip, from the outer-most drillhole intersections. The drilling grid spacing used was generally 200-250 m so the extrapolation distance is half of the typical grid spacing.

Three different block models were developed for the Rupsi, Dypet, Hankabakken and Sagmo deposits. For each deposit, the same modelling methodology was applied. A digital terrain model (DTM) was generated, based on the center points on each drillhole intersection. Apparent true thickness measurements were then estimated and used to develop a three-dimensional block model of each zone. Composite grades of copper and zinc were then estimated, based on inverse-distance squared weighting. The previously exploited areas within each mine site were allocated as mined by using perimeters from historical mine plans. These mined areas were therefore excluded from the current resource estimate.

Geology – Mineralization

Rupsi/Dypet deposit

The Rupsi/Dypet deposit is interpreted to correlate with the Hankabakken level and is the northwesternmost deposit in Sulitjelma. Mineralization is characterized by various styles such as massive and semi-massive sulphides, disseminations and veins (stringers) within a chlorite-biotite rich hydrothemal breccia. Two-fold phases have formed a recumbent elongated antiform with ore enrichment in the fold hinge zone. In terms of alteration, the Rupsi deposit manifests an abnormal enrichment in potassium relative to the surrounding strata. The K feldspar-biotite-chlorite ± albite core is enveloped by a more typical chloritic alteration zone characterized by an increasing Fe/(Fe d- Mg) ratio away from the deposit.

Hankabakken deposit

The Hankabakken mine was worked on two different ore bodies, Hankabakken I and II. Hankabakken II is a blind deposit, located some 500 m NW from Hankabakken I. The thickness of the ore bodies was generally 3 m - 5 m and commonly exhibited increasing Cu-content towards the hanging wall.

Sagmo deposit

In the Sagmo deposit, Cu is markedly enriched toward the footwall of the orebody and there is some evidence of Zn and Pb being enriched toward the hanging wall. This may suggest that this orebody is not inverted. Considerable change in the Cu/Zn/Pb ratios of various rock types is also borne out by the associated alteration lithologies. The biotite schists immediately subjacent to the massive ore plot tightly into the Cu corner of the Cu-Zn-Pb ternary diagram. The massive ore is slightly Zn rich. The disseminated host rocks contain a large component of laterally dispersed sulphides that fill a broad area with Cu/Zn ratios ranging between 75:25 to 10:90. Chlorite schists distant to the ore contain appreciably more Zn than Cu, whereas amphibolites which have been leached of Cu but only minimally of Zn show Zn enrichment.

Exploration Plan

Blue Moon’s exploration program for Sulitjelma project is designed to expand known mineralized zones and enhance MRE confidence through a systematic approach to drilling. A key component of the plan is the refurbishment of, and a one-kilometer extension of the historic Rupsi exploration draft, providing improved underground access for detailed mapping, sampling, and drill platform development.

Technical staff are planning to evaluate, confirm, and extend the existing MRE through a series of sectional drill fans that are part of a 10,000 m exploration drilling program. The drilling program will be complemented through soil and core geochemistry, which shall be analyzed using the ioGAS software platform. It is anticipated that results will aid greatly in vectoring towards additional VMS mineralization. Additionally, geological mapping, geophysical surveys, and relogging of historical drill core will occur in 2025 to further refine the geological model and optimize drill targeting. This integrated approach to exploration at Sulitjelma Project is expected to significantly advance the understanding and potential of the project

QAQC

A thorough review of available information on the Sulitjelma Project yields very little quality control and quality assurance (“QAQC”) data that is available regarding sample preparation, laboratory analytical procedures, including the performance standards, blanks and duplicates. There is also no information available about chain of custody security procedures from the historic drilling activities. However, it is presumed that the prior operators conducted both sampling and analytical procedures in accordance with the industry best practices of the time.

Data Verification

Very little information is available on the sample preparation, analysis and security procedures from the historic drilling activities, which occurred in the evaluated areas between 1952 and 1988. The fact that so much Sulitjelma core is still in reasonable condition at the NGU core archive at Løkken demonstrates the sound procedures which must have been in place when the original samples were taken. There are no records describing the assay methods used. However, from examination of the compiled assay data, the limits of detection appear to have been 0.01% Cu and 0.01% Zn.

Blue Moon provided full access to all facilities and personnel during the visits. The QP also completed checks of:

• Surface collar elevation data relative to surface topography data.

• Drillhole data integrity.

• Drillhole data against pre-existing plans and cross-sections.

• Additional density measurements of Sulitjelma core samples, taken during February 2025.

The QP has reviewed the available sample data and corresponding information, and although there is a lack of QAQC information available, is of the opinion that the data available for the Mineral Resource estimation are of sufficient quality to estimate mineral resources for an Inferred category, in accordance with CIM guidelines.

Qualified Persons

The Technical Report on the Mineral Resources of the Sulitjelma Project, Norway, was prepared solely by Qualified Person (QP) Adam Wheeler (C.Eng., Eur Ing, FIMMM), an independent mining consultant.

Adam Wheeler has been involved with the Sulitjelma Project since 2021. He conducted a site visit on December 2, 2024 and reviewed drill core from the project at the NGU core storage facilities in Løkken, Norway on December 3, 2024.

The technical and scientific information of this news release has been reviewed and approved by Mr. Dustin Small, P.Eng., a non-Independent Qualified Person, as defined by NI 43-101. It has also been reviewed by Mr. Wheeler (C.Eng., Uur Ing, FIMMM), the independent QP.

About Blue Moon

Blue Moon is advancing 3 brownfield polymetallic projects, including the Nussir copper-gold-silver project in Norway, the NSG copper-zinc-gold-silver project in Norway and the Blue Moon zinc-gold-silver-copper project in the United States. All 3 projects are well located with existing local infrastructure including roads, power and historical infrastructure. Zinc and copper are currently on the USGS and EU list of metals critical to the global economy and national security. More information is available on the Company’s website (www.bluemoonmetals.com).

For further information

Blue Moon Metals Inc.

Christian Kargl-Simard

CEO and Director

Phone: (416) 230 3440

Email: christian@bluemoonmetals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY DISCLAIMER - FORWARD LOOKING STATEMENTS

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of applicable Canadian and U.S. securities laws. All statements included herein that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking information may in some cases be identified by words such as “will”, “anticipates”, “expects”, “intends” and similar expressions suggesting future events or future performance. Forward-looking statements in this press release include, but are not limited to, statements regarding: the anticipated results of the Technical Report; the filing of the Technical Report and the timing thereof; the Company’s plans to advance the project through additional exploration and technical studies; the initial exploration focus area and timing of anticipated exploration activities; the recommended work program and budget thereof; the refurbishment and extension of the existing historical mine tunnel; the recommended exploration drilling program; the exploration plan; management statements regarding Blue Moon bringing mining back to the district; the plan to start underground development and the timing thereof.

We caution that all forward-looking information is inherently subject to change and uncertainty and that actual results may differ materially from those expressed or implied by the forward-looking information. A number of risks, uncertainties and other factors could cause actual results and events to differ materially from those expressed or implied in the forward-looking information or could cause our current objectives, strategies and intentions to change, including but not limited to: that the anticipated results of the Technical Report will not be realized; that the Technical Report may not published at all or within the expected timeframe; that the Company may not advance the project at all or through the anticipated additional exploration and technical studies; the initial exploration focus area may differ from the anticipated; the exploration activities may not commence at all or within the anticipated timing thereof; the recommended work program and budget thereof may not be realized; the existing historical mine tunnel may not be refurbished and extended; the recommended exploration drilling program may not be commenced or completed; the exploration plans may differ from the anticipated; that Blue Moon may not bring mining back to the district; that the underground development may not comment at all or within the anticipated timing thereof. Accordingly, we warn investors to exercise caution when considering statements containing forward-looking information and that it would be unreasonable to rely on such statements as creating legal rights regarding our future results or plans. We cannot guarantee that any forward-looking information will materialize and you are cautioned not to place undue reliance on this forward-looking information. Any forward-looking information contained in this news release represents management’s current expectations and are based on information currently available to management and are subject to change after the date of this news release. We are under no obligation (and we expressly disclaim any such obligation) to update or alter any statements containing forward-looking information, the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law. All of the forward-looking information in this news release is qualified by the cautionary statements herein.

Forward-looking information is provided herein for the purpose of giving information about the Sulitjelma Project and its expected impact. Readers are cautioned that such information may not be appropriate for other purposes.

A comprehensive discussion of other risks that impact Blue Moon can also be found in its public reports and filings which are available at www.sedarplus.ca.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/68ce30eb-ecf4-4291-b056-1866975fac22

Distribution channels: Media, Advertising & PR, Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release